The Sailthru and Forbes study showed that only 15% of companies are able to tie the calculation of customer lifetime value to revenue and growth and that nearly 50% of all companies cite the lack of a consistent cross-channel experience as an impediment to loyalty. Read the report here.

A global study of 300 retail and media executives discovered that ‘retention gurus’ have significantly increased market share than ‘acquisition athletes’. Here, Neil Lustig examines the findings.

When it comes to customer acquisition, both retailers and media companies appear to be at the top of their games. Unfortunately, that’s not even remotely the case when it comes to customer retention.

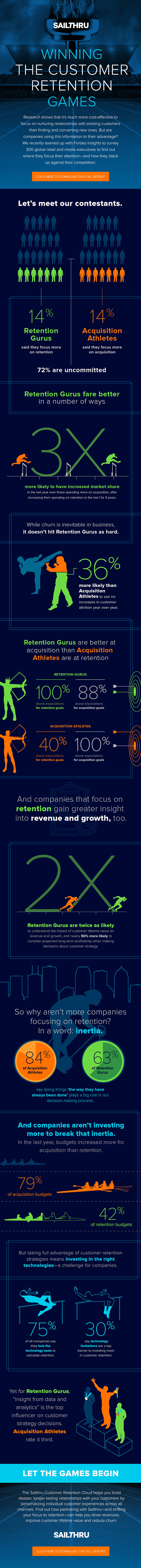

At the end of 2015, Sailthru, together with Forbes Insights, surveyed 300 retail and media executives to discover how they approach customer retention and how they leverage it throughout their enterprises. We found that in 14 per cent of companies retention investments and performance in retention are increasing, so we called them the ‘retention gurus’. Another 14 per cent did just the opposite – they favoured acquisition over retention by way of investments and focus, so we called them the ‘acquisition athletes’.

One of the questions we asked each of the executives was how well they thought they understood various customer metrics, and the driving forces behind them, in their particular organisation. The good news is that, no matter how you slice it, the companies have a really good grasp on the factors that drive their customer acquisition. Ninety-five per cent of retention gurus, 95 per cent of acquisition athletes, 96 per cent of retail companies and 100 per cent of media companies say they fully understand their most valuable acquisition channels.

Customer lifetime value, and the drivers behind it, is another area where marketers are hitting it out of the park. Ninety-five per cent of both the acquisition and the retention crowd have got a good handle on this. If we look at it by industry, we find that 97 per cent of retail executives and 100 per cent of those in media say they understand this quite well.

When it comes to customer churn rate, the stats are still strong, although not quite as stellar. Eighty-four per cent of retention gurus and 87 per cent of acquisition athletes significantly understand the causes and effects of their customer churn rates. Media companies are doing somewhat better than retailers here, with 91 per cent of media companies and 86 per cent of retailers saying they’re on top of this.

Retentionomics – the opportunity

But when it comes to retention, awareness and understanding drops pretty quickly. That’s disappointing, given that it’s so much less expensive to convince an existing customer to buy again than it is to bring a new one on board. It could also be that many digital retailers and media companies have only recently realised that there are not, after all, endless fish in the sea. The universe of new customers that one can recruit in a given target market is not actually infinite, even though it may have seemed that way just a few years ago. That means profitable, sustainable growth depends on getting existing customers to visit your media site, or make purchases, repeatedly.

Retention gurus, as you might expect, do better here than acquisition athletes, but there’s still lots of room for improvement. Among retention gurus, 68 per cent say they significantly understand their enterprise’s repeat purchase or repeat visit rate, compared to just 54 per cent of acquisition athletes. Media companies score better on this metric than retailers.

But when asked how well marketers and publishers understood their best retention channels, things start to fall apart. Even retention gurus are still learning how the various channels interact for their customers and readers, with just 55 per cent saying they understand them significantly. Acquisition athletes are way behind, with just 26 per cent understanding their best retention channels.

What’s most disturbing about these numbers is that it’s the same companies answering this question that answered those regarding repeat visit rate, customer lifetime value and customer churn. Those metrics are critical to understanding retention. If so many claim that they do have a grasp on the causes and effects of those metrics, one would assume they also understand their most valuable retention channels.

We all know that retention is more challenging to calculate than acquisition, which is simply cost versus value; this many dollars out, this many consumers in. But no matter what the cause, both groups still have lots of opportunity to grow and to better understand the metrics that drive their businesses and their profession.